ICI Viewpoints

Investing Basics: Diversification

As part of the ICI Education Foundation’s 30th anniversary celebration, we will be sharing a series of ICI Viewpoints explaining basic investing concepts, drawn from the ICI Education Foundation’s Investing Road Trip.

Eggs play a starring role in diversification’s ubiquitous analogy—one we used in the Investing Road Trip©—and for good reason. If you drop a basket holding all your eggs, you’ll be out a lot of eggs. Spreading your eggs across several baskets is a good defense against the risks of exposing all your assets to the same risk.

Let’s Feast…on Diversification

But perhaps we should also make the point that eggs shouldn’t be the only food in your basket. They may be high in protein, but your body needs a mix of nutrients for good health. Similarly, with investing, a better goal is to build a balanced “diet” of asset classes across industries, geographic areas, and types of securities.

Holding investments that are less likely to react in the same way to changes in the economy or market conditions can blunt losses to your portfolio. Conversely, diversification can provide opportunities for greater returns than you otherwise may have had with a more limited portfolio.

The Diversified Diet: Introducing Carbs

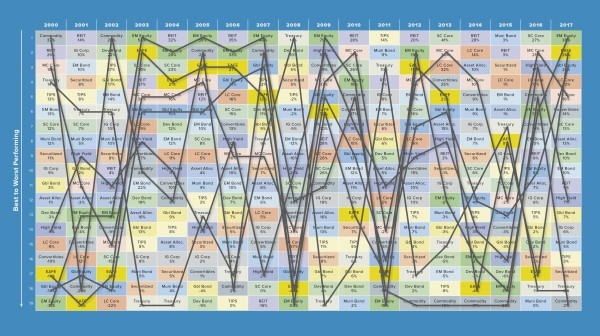

Part of the reason why diversification is so important is because it’s so difficult to predict investing winners and losers from one year to the next. To see why, check out the chart below. Sure, it looks like a bowl of spaghetti, but it actually ranks the relative performance of 19 asset classes, each shown in a different color, from 2000 to 2017. Follow—if you can—one of the lines as it tracks an asset class from year to year, and one thing is clear: one year’s top performer is often next year’s dud.

For many investors, volatility—and the uncertainty it can bring—is one of the most unsettling realities of investing. But building a diversified investing plan and being comfortable with the risks you’ve taken on will see you through the inevitable ups and downs of investing. You won’t panic when things get bumpy or when one hot pick goes cold—and, in the long-run, you’ll be better off than those who chase returns.

Cook Up Something Good

This post’s egg and pasta feast may inspire a spaghetti carbonara craving, but it’s my hope that it provides the ingredients to cook up a well-rounded view of diversification.

- Investing Basics: What Is Investing?

- Investing Basics: What Is Risk?

- Investing Basics: Types of Investments

- Investing Basics: Diversification

- Investing Basics: Dollar-Cost Averaging

- Investing Basics: The Benefits of Mutual Funds

- Investing Basics: Tax Benefits to Encourage Saving

- Investing Basics: 529 Savings Plans

- Investing Basics: Compound Returns and the Power of Reinvestment