News and Resources

During Challenging Year, Savers Overwhelmingly Preserved Retirement Nest Eggs

2020 data covering more than 30 million accounts show continued contributions, ongoing investment, and modest withdrawal activity

Washington, DC; February 25, 2021—Americans overwhelmingly continued saving for retirement in 2020 through defined contribution (DC) plans such as 401(k)s, in spite of the economic downturn brought about by the COVID-19 pandemic, according to ICI’s “Defined Contribution Plan Participants’ Activities, 2020.” The study tracks contributions, withdrawals, and other activity in 401(k) and other DC retirement plans, based on DC plan recordkeeper data covering more than 30 million participant accounts in employer-based DC plans at the end of December 2020. This edition of the study continues to track coronavirus-related distributions (CRDs) among plan participants to provide insight into financial activity related to the pandemic.

“Despite the many challenges over the past year, the data indicate retirement savers generally were committed to preserving their nest eggs,” said Sarah Holden, ICI senior director of retirement and investor research. “These data suggest that DC plan savers view their 401(k) as a special pot of money earmarked for retirement, which they try to avoid tapping into, even in tough economic times.”

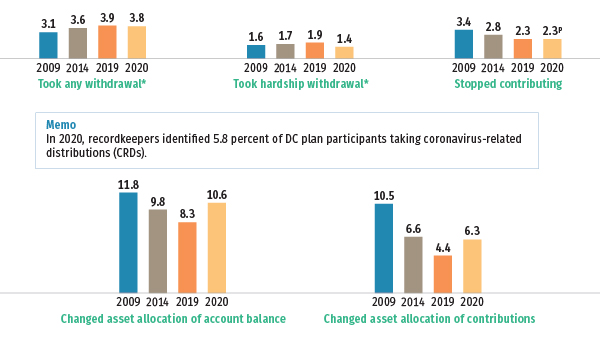

The latest recordkeeper data indicate that DC plan participants remained committed to saving and investing. Preliminary estimates indicate that only 2.3 percent of DC plan participants stopped contributing to their plans in 2020, consistent with activity in the majority of the prior 12 years for which ICI has tracked these data. That compares with 2.3 percent in 2019 and 3.4 percent in 2009—another time of financial stress. Most DC plan participants stayed invested: about one in 10 DC plan participants changed the asset allocation of their account balances and fewer than one in 10 changed the investment of their contributions.

Defined Contribution Plan Participants’ Activities

Summary of recordkeeper data, percentage of participants

* These withdrawals do not include coronavirus-related distributions (CRDs) identified by the recordkeepers.

p Data are preliminary based on a partial sample of DC plans in the survey.

Note: The samples include about 24 million DC plan participants in 2009; more than 25 million DC plan participants in 2014; and more than 30 million DC plan participants in 2019 and 2020.

Source: ICI Survey of DC Plan Recordkeepers

Other findings include:

- Most DC plan participants stayed the course with their asset allocations despite high stock market volatility in the first quarter of 2020. In 2020, 10.6 percent of DC plan participants changed the asset allocation of their account balances, lower than 11.8 percent in 2009 as the stock market started to recover from the global financial crisis. In 2020, 6.3 percent changed the asset allocation of their contributions, lower than 10.5 percent in 2009.

- DC plan withdrawal activity in 2020 remained low, in line with the activity observed in recent years. In 2020, 3.8 percent of DC plan participants took withdrawals, compared with 3.1 percent in 2009. Levels of hardship withdrawal activity also remained low. Only 1.4 percent of DC plan participants took hardship withdrawals during 2020, compared with 1.6 percent in 2009. Hardship withdrawal activity may reflect increasing awareness of expanded hardship withdrawal availability from the Bipartisan Budget Act of 2018 and the onset of financial stresses relating to the COVID-19 pandemic.

- In addition, the surveyed recordkeepers identified 5.8 percent of DC plan participants as taking CRDs during 2020. The Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted March 27, 2020, provided increased flexibility for retirement plan savers, including penalty-free withdrawals, through December 30 for individuals affected by COVID-19.

- DC plan participants’ loan activity edged down in 2020, perhaps partly reflecting the use of CRDs instead of loans. At the end of December 2020, 14.8 percent of DC plan participants had loans outstanding, compared with 16.1 percent at year-end 2019. CRDs, like loans, can be repaid into a retirement account; however, unlike loans, CRDs may have current income tax implications.

ICI has been tracking DC plan participant activity through recordkeeper surveys since 2008. This update provides results from ICI’s survey of a cross section of recordkeeping firms representing a broad range of DC plans. Please visit ICI’s 401(k) Resource Center for more information.