New ICI and IDC Survey Results Provide Benchmark for Improving Diversity and Inclusion in Asset Management Industry

Industry committed to making progress

Washington, DC; February 23, 2021—The first publicly available results from industrywide surveys by the Investment Company Institute (ICI) and Independent Directors Council (IDC) drive home the need for greater representation of women and minorities in all levels of asset management. At the same time, a survey of ICI member firms’ diversity and inclusion (D&I) policies indicates members’ commitment to increase diversity in their organizations.

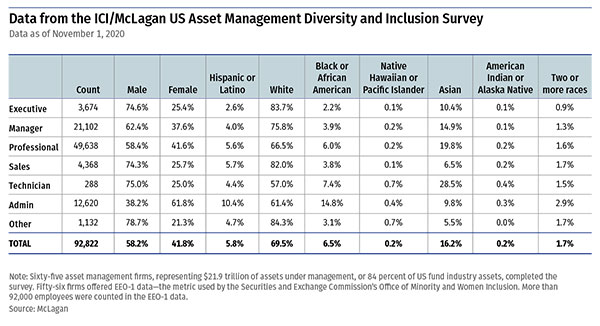

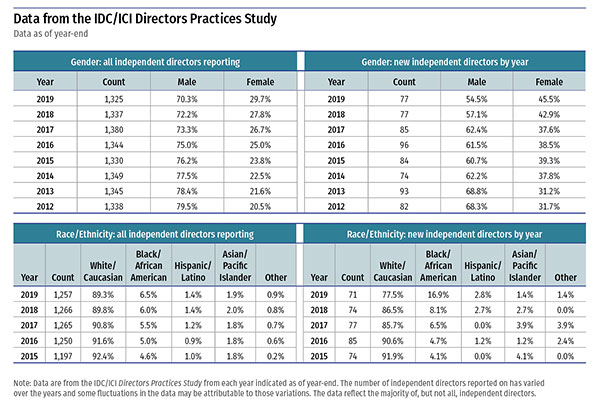

ICI and IDC conducted separate surveys about the number of women and members of racial and ethnic minority groups throughout the industry. ICI partnered with McLagan to conduct a survey of management companies throughout the asset management industry (management survey). McLagan is part of Aon’s Human Capital Solutions group, which delivers compensation data, analytics, and advice to the world’s leading financial services firms. IDC collected data on fund boards through the IDC/ICI Directors Practices Study (director survey).

“These surveys lay a critical foundation of accountability,” said George C. W. Gatch, chairman of ICI and chief executive officer of J.P. Morgan Asset Management. “You manage what you measure, and the survey results provide a benchmark for the industry so we can make meaningful progress toward creating a more diverse and inclusive industry, in fund management and in fund governance.”

Management Survey Demonstrates Need for More Targeted Initiatives to Increase Diversity and Inclusion

According to the management study, women represent 41.8 percent of the asset management industry’s workforce while minorities make up 30.5 percent. The survey results show the percentages of minorities in six categories:

- Asian American: 16.2 percent

- Black or African American: 6.5 percent

- Hispanic or Latino: 5.8 percent

- Native Hawaiian or other Pacific Islander: 0.2 percent

- American Indian or Alaska Native: 0.2 percent

- Employees identifying with two or more races: 1.7 percent

The survey looked at demographics for a range of job levels, as defined by the federal government’s EEO-1 reporting categories for employers—the metric used by the Securities and Exchange Commission’s Office of Minority and Women Inclusion. The data (attached below) show that women and minorities are significantly less present at management and executive levels than at administrative and staff levels.

“The numbers don’t lie,” said Mellody Hobson, a member of the ICI Board of Governors and co-CEO and president of Ariel Investments. “The data tell a truth we’ve long known—we must ensure more women and minorities are working in all levels of asset management by creating opportunities for advancement. We have a long way to go, but I’m glad we are holding ourselves accountable and are making the commitment to improve.”

In addition to gathering gender, racial, and ethnic data, ICI’s survey also asked about asset management firms’ D&I policies, finding that:

- 89 percent include D&I considerations as part of their strategic plans for recruiting, hiring, retaining, and promoting employees;

- 84 percent take steps to promote a diverse pool of candidates when selecting executive and senior level officials;

- 83 percent have a written D&I policy that is approved or supported by the CEO or other senior level official;

- 78 percent provide regular reports on D&I efforts to a board of directors or other governing body; and

- 44 percent include D&I objectives in performance plans of their managers.

Director Survey Illustrates Progress Among New Independent Directors

The director survey is part of the IDC/ICI Directors Practices Study, a proprietary survey that provides information about common fund governance practices and offers data on independent directors, including newer independent directors. The study shows that as of 2019:

- Women represent 29.7 percent of all independent directors and 45.5 percent of independent directors who were nominated and started serving in 2019.

- Minorities represent 10.7 percent of all independent directors and 22.5 percent of independent directors who were nominated and started serving in 2019.

The director survey breaks down minority representation among reporting directors in four categories:

- Black/African American: 6.5 percent of all independent directors, 16.9 percent of independent directors who were nominated and started serving in 2019

- Hispanic/Latino: 1.4 percent of all independent directors, 2.8 percent of independent directors who were nominated and started serving in 2019

- Asian/Pacific Islander: 1.9 percent of all independent directors, 1.4 percent of independent directors who were nominated and started serving in 2019

- Other: 0.9 percent of all independent directors, 1.4 percent of independent directors who were nominated and started serving in 2019

“The percentages of women and minorities represented among newer independent directors joining fund boards demonstrate that the director community is making strides toward including more diverse perspectives in the boardroom,” said Kathleen Barr, chair of IDC’s Governing Council and an independent director of William Blair Funds and the Professionally Managed Portfolios. “There is still a great deal of progress to be made, and IDC’s D&I working group is identifying actionable steps to help foster a diverse and inclusive fund director community.”

The full data for the director survey are attached below.

Industry Strongly Committed to Making Meaningful Progress

“As an industry, we can—and we will—do more to increase the number of women and minorities working throughout the asset management industry,” said Eric J. Pan, ICI president and CEO. “To achieve that objective, ICI is working with its members to develop and implement new targeted initiatives within firms and industrywide. These initiatives aim to make meaningful progress toward ensuring that women and minorities are fully represented at every level of the asset management industry.”

One such recently announced initiative is ICI’s Talent Connection—a program to encourage more women and minority students to consider careers in the asset management industry and help the industry form a robust pipeline of qualified job candidates. Through webinars and other events, ICI and industry representatives will give minority students a detailed introduction to positions available in asset management and inform them of the substantial career opportunities in the industry. For example, more than 70 law students registered for the first event, scheduled for February 23, focusing on legal and compliance careers in asset management.

In addition to Talent Connection, ICI—through the ICI Education Foundation—supports The Robert Toigo Foundation’s work to advance the careers and leadership of underrepresented talent in finance.

ICI’s Methodology for Management Survey

Sixty-five asset management firms, representing $21.9 trillion of assets under management, or 84 percent of US fund industry assets, completed the survey, with 56 firms offering EEO-1 data. The data are as of November 1, 2020, and more than 92,000 employees were counted in the EEO-1 data. ICI will conduct the study on a regular basis.

IDC’s Methodology for Director Survey

The latest IDC/ICI Directors Practices Study examined 181 fund complexes, with assets under management of $23.4 trillion, about the gender, racial, and ethnic makeup of their fund boards. Those participants reported data on 235 fund boards. The data are as of December 31, 2019.