European Union UCITS Costs Have Declined Steadily

New analysis tracks trend in average ongoing charges

London, 23 September 2019—The average ongoing charges for both equity and fixed-income UCITS fell by approximately 20 basis points between 2013 and 2018, according to “Ongoing Charges for UCITS in the European Union,” a new research report from the Investment Company Institute (ICI).

The ongoing charge is the fund’s total annual ongoing cost as a percentage of its total net assets. Many factors are driving the downward trend in ongoing charges, according to the report, including:

- Investors are concentrating assets in lower-cost UCITS.

- New, lower-cost UCITS are opening, while higher-costs UCITS are closing.

- Average fund net assets are increasing, enabling greater economies of scale.

- Index tracking investment is growing.

“Today’s UCITS managers are serving investors in a highly competitive, dynamic, and diverse fund marketplace,” said ICI associate economist James Duvall, coauthor of the report. “This research shows that investors are studying fees carefully, and increasingly invest in lower-cost UCITS.”

“Regulatory changes, including MiFID II, have fostered simpler and more transparent fee disclosure,” added report coauthor Giles Swan, director of global funds policy at ICI Global. “This report will further inform the regulatory dialogue around fee disclosure, especially efforts to improve investors’ understanding of what distribution costs encompass and how they pay for them.”

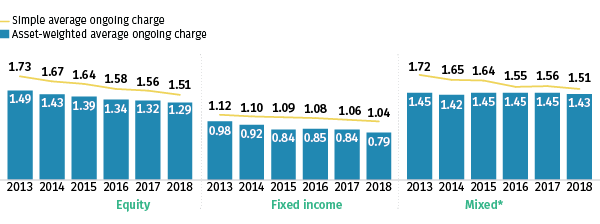

The report shows that the asset-weighted average ongoing charges for equity UCITS, excluding exchange-traded funds (ETFs), fell to 1.29 percent in 2018, down from 1.49 percent in 2013. For fixed-income UCITS, the asset-weighted average ongoing charges were 0.79 percent in 2018, compared with 0.98 percent in 2013. Asset-weighted averages—which give more weight to the fees of funds that hold greater assets—reflect the charges that investors in the aggregate actually pay. That is in contrast to the simple average, which weights the charges of each fund equally.

Ongoing charges in UCITS invested in a mix of equity and fixed income were mostly unchanged.

Investors in UCITS Pay Below-Average Ongoing Charges

Percent

* Mixed funds invest in a combination of equity and fixed-income securities.

Note: Data exclude exchange-traded funds.

Source: Investment Company Institute tabulations of Morningstar Direct data

Investors Are Concentrating Assets in Lower-Cost UCITS

ICI’s analysis found the investor shift toward lower-cost UCITS was the most influential trend driving the decline in ongoing charges. Asset movement into lower-cost funds was responsible for 13 basis points, or 65 percent, of the decrease in ongoing charges for equity funds. For fixed-income funds, the same shift was responsible for 18 basis points, or 95 percent, of the reduction.

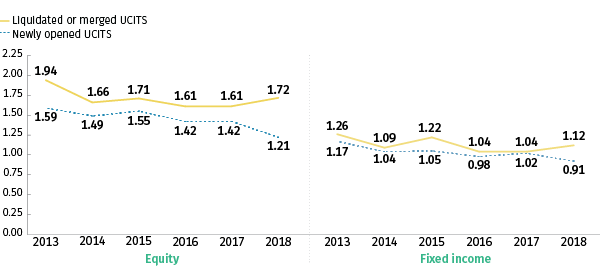

Lower-Cost UCITS Are Opening While Higher-Cost UCITS Are Closing

The decline in ongoing charges also stems from an intensively competitive investment environment in which older, higher-cost funds exit while new, lower-cost funds—including index tracking funds—enter.

For example, the report shows that net assets of index tracking UCITS have more than doubled since 2013, from €224 billion to €466 billion. However, these assets remain relatively small, representing 7.6 percent of all UCITS net assets at the end of 2018.

The findings also illustrate the influence of the recast Markets in Financial Instruments Directive (MiFID II). To comply with MiFID II, some UCITS created unbundled share classes for retail investors. These share classes—which exclude commission payments for advice—generally have lower ongoing charges when compared with similar funds. Retail investors in such share classes typically pay distribution costs directly out of pocket.

In 2018, the simple average ongoing charge for newly opened equity UCITS was 1.21 percent, 30 basis points less than the simple average ongoing charge of 1.51 percent across all equity UCITS. Similarly, the simple average ongoing charge for newly opened fixed-income UCITS was 0.91 percent compared with the simple average ongoing charge of 1.04 percent for all fixed-income UCITS.

Simple Average Ongoing Charges of Newly Opened UCITS Are Decreasing

Percent

Note: Data exclude exchange-traded funds.

Source: Investment Company Institute tabulations of Morningstar Direct data

Average Ongoing Charges Are Falling for Both Actively Managed and Index Tracking UCITS

From 2013 to 2018, ongoing charges for actively managed equity UCITS dropped from 1.56 percent to 1.39 percent, while ongoing charges for index tracking equity UCITS fell from 0.40 percent to 0.28 percent.

From 2013 to 2018, ongoing charges for actively managed fixed-income UCITS fell from 0.99 percent to 0.81 percent, while ongoing charges for index tracking fixed-income UCITS dropped from 0.21 percent to 0.14 percent.

About ICI Global

ICI Global carries out the international work of the Investment Company Institute, the leading association representing regulated funds globally. ICI’s membership includes regulated funds publicly offered to investors in jurisdictions worldwide, with total assets of US$30.4 trillion. ICI seeks to encourage adherence to high ethical standards, promote public understanding, and otherwise advance the interests of regulated investment funds, their managers, and investors. ICI Global has offices in London, Hong Kong, and Washington, DC.