Target Date Funds Widely Used by Younger Plan Participants

Equities remain dominant investment choice in 401(k) plans

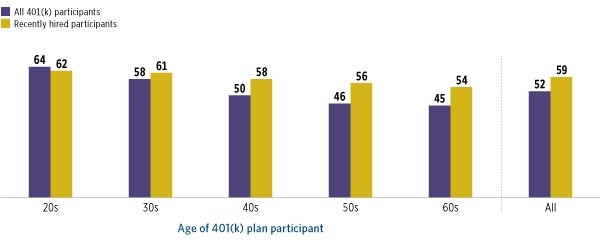

Washington, DC; September 10, 2018—Younger 401(k) plan participants have large allocations to target date and other types of balanced funds, according to a new joint study released today by the Investment Company Institute (ICI) and the Employee Benefit Research Institute (EBRI). At year-end 2016, 64 percent of 401(k) participants in their twenties held target date funds, compared with 45 percent of 401(k) participants in their sixties. Target date funds are a popular choice for 401(k) plans’ investment lineups.

The study, “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2016,” shows that among recently hired participants (those with two or fewer years of tenure) target date funds are used at a higher rate—59 percent—compared with 52 percent of all 401(k) plan participants who invest in those funds. Target date funds are designed to offer a diversified portfolio that focuses on growth for younger participants and automatically rebalances to focus more on fixed-income investments for workers as they near—and enter—retirement.

“Target date funds continue to be a widely available, widely used, popular, and convenient investment choice for retirement savers, as they offer portfolio diversification and automatic rebalancing over time,” said Sarah Holden, ICI senior director of retirement and investor research. “Recently hired workers, in particular, often hold target date funds in their 401(k) plan accounts, reflecting current 401(k) plan design.”

Target Date Fund Ownership Tends to Be Higher Among Recent Hires

Percentage of 401(k) plan participants holding target date funds by age, 2016

Note: Recently hired 401(k) plan participants are those with two or fewer years of tenure.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

The new study also shows that more 401(k) plan participants hold equities than before the financial crisis of 2008. About 67 percent of 401(k) assets continued to be invested in stocks in 2016, through equity funds, the equity portion of balanced funds, and company stock. An additional 27 percent of 401(k) assets were in fixed-income securities such as stable value investments, bond funds, money funds, and the fixed-income portion of balanced funds.

“Retirement savers continue to invest heavily in equities through their 401(k) plans,” said Jack VanDerhei, EBRI research director. “Though this is in large part driven by younger plan participants, savers in their sixties also remain focused on growth and held 55 percent of their 401(k) plan assets in equity investments.”

In 2016, only 7 percent of 401(k) plan participants in their twenties had no equities, while 77 percent of these younger plan participants had more than 80 percent of their account balances invested in equities. In comparison, 11 percent of 401(k) plan participants in their sixties had no equities, while 19 percent of them had more than 80 percent of their account balances invested in equities.

Other findings in the study include:

Average 401(k) account balances increase with participant age and tenure. For example, at year-end 2016, participants in their forties with more than two years and up to five years of tenure had an average 401(k) balance of about $38,000, while participants in their sixties with more than 30 years of tenure had an average 401(k) account balance of more than $287,000.

401(k) participants’ investment in company stock continued at historically low levels. Only 6 percent of 401(k) plan assets were invested in company stock at year-end 2016. This share has fallen by more than two-thirds since 1999, when company stock accounted for 19 percent of assets.

401(k) participant loan activity edged up slightly at year-end 2016 compared with year-end 2015. At the end of 2016, 19 percent of all 401(k) participants who were eligible for loans had loans outstanding against their 401(k) accounts, slightly up from 18 percent at year-end 2015.

The study is based on the EBRI/ICI database of employer-sponsored 401(k) plans, the largest database of its kind, compiled through a collaborative research project undertaken by the two organizations since 1996. The 2016 EBRI/ICI database includes statistical information on 27.1 million 401(k) plan participants in 110,794 plans, which hold $2.0 trillion in assets and cover 49 percent of the universe of active 401(k) participants.

Full results of the annual EBRI/ICI 401(k) database update are posted on each organization’s website, at www.ebri.org and https://www.ici.org/research/investors/ebri_ici.