News Release

ICI Urges SEC to Take Action to Ensure Fund Shareholders Benefit from Web Delivery of Fund Reports

Calls on FINRA to Assume Responsibility for Processing Fees to Ensure Fair Treatment of Shareholders

Orlando, FL, March 14—Unless the Securities and Exchange Commission (SEC) takes action, processing fees could erase $1 billion from the savings that fund shareholders are expected to reap under the Commission’s proposed rulemaking on website delivery of shareholder reports, warned Investment Company Institute (ICI) General Counsel David W. Blass.

“Allowing funds to deliver shareholder reports through a website will help the industry harness technology to create savings for funds and their shareholders,” said Blass. “Unfortunately, hurdles remain that require SEC action to clarify how the processing fees for website delivery will work and ensure the process has strong oversight to protect investors from abusive, vendor-administered fees.”

Blass’s remarks, which opened ICI’s annual Mutual Funds and Investment Management Conference, coincided with a letter from ICI President and CEO Paul Schott Stevens today, calling upon the SEC to consider new information and make critical adjustments to ensure that this part of its proposed reporting modernization rulemaking (proposed rule 30e-3) is implemented to the greatest benefit of shareholders.

ICI calculates that the printing and mailing of paper shareholder reports—the current default delivery mode—costs fund shareholders about $308 million annually. Nearly 2 million trees are cut down each year to make the paper needed for shareholder reports.

The approach ICI recommends for proposed rule 30e-3 would allow funds to substitute a postcard notice indicating the website where the report is available online for the full paper report. Shareholders could use the notice’s toll-free number to request a paper report. ICI estimates this approach would save shareholders close to $2 billion in the first 10 years.

Processing Fees Threaten Shareholder Savings Under Proposed Rule

Savings from the proposed rule are in jeopardy following new information ICI gathered on how third parties will apply processing fees related to the proposed new delivery option. Broadridge Financial Solutions, Inc.—the vendor that handles the delivery of paper shareholder reports for the majority of broker-sold funds—informed ICI it would interpret existing delivery fees set by the New York Stock Exchange (NYSE) in such a way that funds would pay more for not delivering paper shareholder reports than they currently pay to print, mail, and deliver paper reports. To read more about how Broadridge would apply multiple processing fees to website delivery under rule 30e-3, see page six of ICI’s letter to the SEC.

Broadridge’s Interpretation of NYSE Fees Transfers Rule 30e-3 Savings Away from Fund Shareholders to Broadridge or Brokers

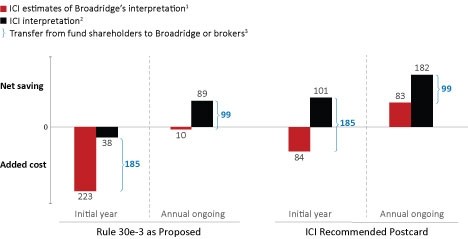

Millions of dollars

1 Sum of print and mail and NYSE processing fee net saving/added cost (see Appendix A, Table 6).

2 Estimates from ICI’s August cost savings analysis.

3 Represents higher NYSE fees, as print and mail costs are identical in both estimates.

If the SEC allows Broadridge’s interpretation to prevail, ICI calculates that implementing the rule in its first year would cost $223 million, rather than $38 million—adding $185 million in costs for shareholders over and above the current costs of paper delivery. In each subsequent year, Broadridge’s approach would wipe out $89 million in shareholder savings and impose $10 million in extra costs. The Broadridge interpretation would have a similar impact on savings projected under ICI’s recommended postcard approach.

Under those conditions, ICI asserted that funds are unlikely to use the optional new delivery mechanism, thwarting the SEC’s goal in proposing rule 30e-3.

FINRA Should Assume Responsibility for Rules Governing Fees

ICI contends the emergence of Broadridge’s views highlights the need to revisit how the fee schedule established under the NYSE rules applies to delivery of fund materials. ICI calls out several “abusive” practices that have been permitted to evolve under the current fee framework, including kickbacks to brokers, and the continued application of “incentive fees” in perpetuity, long after elimination of the need to mail materials in paper format.

ICI believes fund shareholders would be better served by a separate, specifically tailored fee schedule for processing costs associated with delivery of fund materials. Stevens’ letter asks the SEC to direct the Financial Industry Regulatory Authority, Inc. (FINRA) to assume primary responsibility for regulation of the fees brokers charge for delivery of fund materials. Stevens asserted that:

“FINRA is the only appropriate self-regulatory organization for developing and scrutinizing these fees, as investor protection is integral to its mandate…. At a time when the investing public and regulators are so sensitive to the impact of fees on investors’ ability to meet their retirement savings or other goals, these processing fees and the system under which fees are charged cry out for more robust oversight.”

SEC Must Recognize Self-Interest of Critics of E-Delivery

ICI urged the SEC to recognize the self-interest underlying comment letters filed by members of the paper, envelope, and related industries, who have opposed the new rule—at times without disclosing their industry ties.

ICI rebutted the paper and consumer lobbies’ argument that online delivery would disadvantage the elderly, based on claims that older shareholders lack access to the Internet. ICI noted that the paper industry’s comments to the SEC inaccurately portray fund shareholders’ Internet access as lower than it actually is. As Blass said at the conference:

“The truth is, fund shareholders are a tech-savvy lot. They have greater access to the Internet—spread across ages, incomes, and levels of education—and make more use of it for financial purposes than the general population. This is especially true for people aged 65 or older.”

A 2015 ICI survey found that 91 percent of U.S. households owning mutual funds had Internet access, with widespread use among various age groups, education levels, and income levels, ICI’s letter noted. And mutual fund shareholders aged 65 or older have the same Internet use rates as the general population as a whole—84 percent. Beyond Internet access, mutual funds are seeing shifts in how shareholders actually use fund websites—for handling their investment transactions as well as for information access. An ICI survey also found that member fund companies stand ready to fulfill shareholder requests to receive paper reports by mail. (To read ICI’s analysis of rule 30e-3 critics’ assertions, please see page 15 of Stevens’ letter to the SEC.)