News Release

APAC Region’s 2015 Fund Sales Outpaced Europe, Americas

New Data from ICI Fact Book Available Online

Washington, DC, 7 July 2016 - For the first time, net sales of regulated open-end funds in the Asia-Pacific (APAC) region outpaced sales in Europe or the Americas, according to new data in the 2016 Investment Company Fact Book, newly published in a searchable HTML format by the Investment Company Institute.

Net sales in the APAC region totaled more than $770 billion in 2015—40 percent of all global net fund sales. This marks a substantial increase since 2014, when net sales in the region were only 17 percent of the total global net sales. Net sales in Europe constituted the next largest segment of the global total in 2015 with 37 percent, and the Americas accounted for 23 percent.

Growth in APAC markets in 2015 was fueled primarily by inflows into money market funds (MMFs), which account for 38 percent, or $297 billion, of total net sales in the region, according to data from the International Investment Funds Association. The recent growth in MMFs is due to the growing use of online investing tools that have been made available in recent years. Equity funds were also popular in 2015, representing 27 percent of net sales, and balanced/mixed funds made up 21 percent. Bond funds were 10 percent of total net sales in the APAC region in 2015.

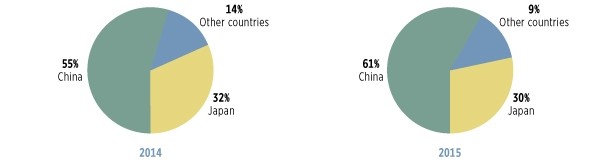

More Than Half of Asia-Pacific Region Net Sales Are in Chinese Funds

Percentage of Asia-Pacific net sales; year-end, 2014–2015

Note: Components may not add to total because of rounding. ETFs and institutional funds are included. Funds of funds are excluded.

Source: International Investment Funds Association

With 61 percent of APAC’s net sales, Chinese funds represented the majority of the region’s 2015 total, as they did in 2014 when net sales to Chinese funds were 55 percent of all net sales in the region. Japan made up another 30 percent of net sales, with the remaining 9 percent distributed across the region.

“One factor contributing to the greater demand for regulated funds in the Asia-Pacific region is their growing middle class,” said Sean Collins, ICI senior director of industry and financial analysis. “This has led to dramatic increases in assets under management there. China, for example, is now counted among the top 10 countries in the world for assets under management, due in part to recent inflows to Chinese mixed funds and money market funds.”

Fact Book Also Offers Unique Insight on U.S. Markets

As a primary source of statistical information and analysis on the investment company industry, the Investment Company Fact Book examines the U.S. mutual fund and exchange-traded fund (ETF) markets in depth. The HTML version of the Fact Book allows users to download in electronic form the data behind all of the book’s 205 figures and 67 data tables.

With $17.8 trillion in regulated open-end fund assets under management at year-end 2015, the U.S. market remains the largest in the world, accounting for 48 percent of the $37.2 trillion in these funds worldwide.

The U.S. ETF market is also the largest in the world, making up 72 percent of the $2.9 trillion total worldwide ETF assets, and the growth seen in this market over the past several years has continued. Net issuance of all U.S. ETF shares was at a near-record pace of $231 billion in 2015. U.S. ETFs with a global and international equity focus, meanwhile, had $110 billion in net issuance in 2015, up substantially from $47 billion in 2014.

Please view the Fact Book for more analysis and statistics on the fund industry.