Frequently Asked Questions About Closed-End Funds and Their Use of Leverage

This document contains FAQs about closed-end funds, including information related to failed auctions for auction market preferred stock.

CONTENTS

I. General Information About Closed-End Funds

II. Closed-End Fund Leverage

III. Closed-End Fund Preferred Shares

I. General Information About Closed-End Funds

What are closed-end funds?

Closed-end funds are one of four types of investment companies registered under the Investment Company Act of 1940, along with mutual funds, exchange-traded funds (ETFs), and unit investment trusts. Closed-end funds generally issue a fixed number of shares that are listed on a stock exchange or trade in the over-the-counter market. The assets of a closed-end fund are professionally managed in accordance with the fund’s investment objectives and policies, and may be invested in stocks, bonds, and other assets. The market price of closed-end fund shares fluctuates like that of other publicly traded securities and is determined by supply and demand in the marketplace.

Interval funds represent a subset of closed-end funds. These funds, under Rule 415 and Rule 486 under the Securities Act of 1933 and Rule 23c-3 under the Investment Company Act of 1940, may continuously offer their shares and make offers to repurchase shares at net asset value (NAV) at periodic intervals. For more information on how they operate, see Interval Funds: Operational Challenges and the Industry’s Way Forward and Consider This: Interval Fund Operational Practices.

In what types of securities do closed-end funds invest?

Closed-end funds invest in a wide variety of domestic and foreign securities, including common stocks, preferred stocks, high-yield bonds, municipal bonds, and corporate bonds. Because a closed-end fund does not need to maintain cash reserves or sell securities to meet redemptions, the fund has the flexibility to invest in less-liquid portfolio securities. For example, a closed-end fund may invest in securities of very small companies, municipal bonds that are not widely traded, or securities traded in countries that do not have fully developed securities markets.

How are closed-end funds priced?

Because an exchange-listed closed-end fund’s shares often trade in the stock market based on investor demand, the fund may trade at a price higher or lower than its NAV. For example, a closed-end fund in great demand may trade at a share price higher than its NAV. In this case, the fund’s shares are said to be trading at a “premium” to the NAV. Conversely, a closed-end fund trading at a share price lower than its NAV is said to be trading at a “discount.”

Do some closed-end funds make distributions to shareholders?

Yes. Closed-end funds may make distributions to shareholders from three possible sources: income from interest and dividends; realized capital gains; and return of capital. Some closed-end funds follow a managed distribution policy, which allows a closed-end fund to provide predictable, but not guaranteed, cash flow to common shareholders.

How is a closed-end fund different from an ETF?

Even though both securities are traded on a stock exchange, ETFs have a creation and redemption feature that allows for the number of shares outstanding in any particular ETF to expand or contract on a daily basis much like a mutual fund. This creation/redemption mechanism helps ETFs trade at market prices that approximate the underlying market value of the portfolio. In contrast, the number of shares outstanding in a closed-end fund is relatively stable. A closed-end fund is created by issuing a fixed number of common shares to investors during an initial public offering (IPO), although subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. As a result, closed-end funds may trade at discounts or premiums to the underlying market value of the portfolio. In addition, closed-end funds, unlike ETFs, may issue debt or preferred shares to raise additional capital to purchase more securities for its portfolio. For more information on ETFs, see ICI’s Exchange-Traded Funds Resource Center.

How many closed-end funds are there?

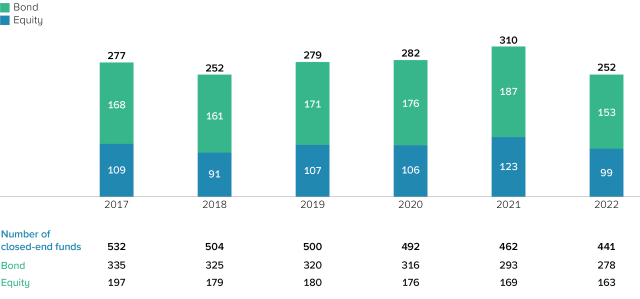

According to ICI data, as of year-end 2022, there were 441 closed-end funds, with $252 billion in total assets.

Total Assets of Closed-End Funds Declined in 2022

Billions of dollars, year-end

Note: Total assets is the fair value of assets held in closed-end fund portfolios funded by common and preferred shares less any liabilities (not including liabilities attributed to preferred shares).

Source: ICI Research Perspective, “The Closed-End Fund Market, 2022” (forthcoming)

What type of shareholder protections do closed-end funds offer?

Closed-end funds are governed by the Investment Company Act of 1940, a law that shapes how all registered investment companies must be structured and operated. All closed-end funds must meet certain operating standards, observe strict antifraud rules, meet diversification requirements, and disclose complete information to investors. The Securities and Exchange Commission (SEC) oversees regulations under the ’40 Act.

Like all registered investment companies, closed-end funds must have a board of directors elected by the fund’s shareholders to oversee the management of the fund’s business affairs and to protect the fund’s interests, taking into account the interests of all shareholders.

II. Closed-End Fund Leverage

Do closed-end funds use leverage?

Yes. Closed-end funds have the ability, subject to strict regulatory limits, to use leverage as part of their investment strategy. The use of leverage allows a closed-end fund to raise additional capital, which it can use to purchase more assets for its portfolio. The use of leverage by a closed-end fund can allow it to achieve higher long-term returns, but also increases the likelihood of share price volatility and market risk.

What types of leverage do closed-end funds use?

Closed-end fund leverage can be classified as either structural leverage or portfolio leverage. Structural leverage, the most common type of leverage used by closed-end funds, affects the closed-end fund’s capital structure by increasing the fund’s portfolio assets. Types of closed-end fund structural leverage include borrowing and issuing debt and preferred shares. The issuance of preferred shares accounts for the majority of closed-end fund structural leverage. Portfolio leverage is leverage that results from certain portfolio investments. Types of closed-end fund portfolio leverage include certain types of derivatives, reverse repurchase agreements, and tender option bonds.

What are the regulatory limits on a fund’s use of leverage?

Under the Investment Company Act of 1940, closed-end funds are subject to asset coverage requirements if they issue debt or preferred shares. For each $1.00 of debt issued, the fund must have $3.00 of assets immediately after issuance and at the time of dividend declarations (commonly referred to as 33 percent leverage). Similarly, for each $1.00 of preferred stock issued, the fund must have $2.00 of assets at issuance and dividend declaration dates (commonly referred to as 50 percent leverage).

Is leverage commonly used?

At year-end 2022, at least 274 funds, accounting for 62 percent of closed-end funds, were using structural leverage, some types of portfolio leverage (i.e., tender option bonds or reverse repurchase agreements), or both as a part of their investment strategy. Preferred share assets were 11 percent, or $28 billion, of total closed-end fund assets as of December 2022.

Does the use of leverage present any risks for common shareholders?

Yes. The net asset value of the common shares and the returns earned by common shareholders will be more volatile in a leveraged closed-end fund than in a fund that does not use leverage. If short-term interest rates rise, the cost of leverage will increase and likely will reduce the returns earned by the fund’s common shareholders.

III. Closed-End Fund Preferred Shares

What are closed-end fund preferred shares?

As previously noted, preferred shares are a form of structural leverage that allow a closed-end fund to raise additional capital, which it can use to purchase more securities for its portfolio. Closed-end funds are permitted to issue one class of preferred shares under Section 18 of the Investment Company Act of 1940. Preferred shares differ from common shares in three ways:

- Preferred shareholders typically are paid dividends at a rate that is fixed for some period.

- Preferred shareholders have priority to income and assets of the fund in the event of liquidation.

- Preferred shareholders do not participate in the gains and losses on the fund’s investments, as common shareholders do.

Do preferred shareholders vote for fund directors?

Yes. Section 18 of the Investment Company Act provides the preferred shareholders with the exclusive right to elect two fund directors. Preferred shareholders also typically vote, together with the common shareholders, to elect the remaining fund directors. In addition, Section 18 provides preferred shareholders with the right to elect a majority of directors if the fund does not pay dividends to the preferred shareholders for a period of two years. Preferred shareholders continue to be entitled to elect a majority of the directors until all dividends in arrears are paid.

Do the directors elected by the preferred shareholders have distinct responsibilities to those shareholders?

No. Neither the Investment Company Act nor the jurisdictions in which most closed-end funds are organized (Maryland and Delaware) assign distinct duties to directors elected by preferred shareholders. Those directors, like all fund directors, owe a fiduciary duty to the fund to act in a manner that protects its interests, taking into account the interests of all shareholders, both common and preferred.

What is the difference between fixed-rate and floating-rate preferred shares?

Fixed-rate preferred shares have a fixed dividend rate that is set at the time of issuance based on market conditions. Floating-rate preferred shares pay a variable rate in the form of interest or dividend income. The rate of return is tied to specific benchmark rate and is adjusted periodically in response to changes in the benchmark rate. As of year-end 2022, 93 percent of preferred share assets were held in floating-rate preferred shares and 7 percent in fixed-rate preferred shares.

What are auction market preferred shares?

Auction market preferred shares are a type of preferred share that pay dividends that vary over time. The dividend rates are set through auctions run by an independent auction agent. An auction is governed by a set of procedures established by the closed-end fund and its auction agent. The dollar amount of outstanding closed-end fund preferred shares has declined since auction market preferred shares, once a common type of preferred share, suffered a liquidity crisis in mid-February 2008. Since then, closed-end funds have replaced auction market preferred shares with alternative forms of structural and portfolio leverage, such as bank loans, lines of credit, tender option bonds, reverse repurchase agreements, puttable preferred shares, mandatory redeemable preferred shares, or extendible notes.

What are puttable preferred shares?

Puttable preferred shares are similar to auction market preferred shares in that they are expected to pay dividends at variable rates. But the two differ in how the dividend rates are set and in the provision of liquidity to avoid the problems raised by failed auctions. Rather than being set through auctions, rates for variable rate demand preferred shares are set through remarketings run by one or more financial institutions acting as remarketing agents. After providing a preliminary notice of the likely dividend rate, the remarketing agents will solicit existing holders and potential buyers for indications of interest to buy or sell. The agents will then match up buyers and sellers at the lowest possible dividend rate. Bids will be filled to the extent shares are available, and sell orders will be filled to the extent there are bids. All filled bids will receive dividends at the new set dividend rate.

Issuance of puttable preferred shares also involves a third party, commonly referred to as a liquidity provider. If there are more sell orders than bids in a remarketing, the liquidity provider will be contractually obligated to unconditionally purchase all puttable preferred shares. As a result of this feature, puttable preferred shares are an eligible investment for money market funds under SEC rules, expanding the market for these shares and decreasing the possibility of failed auctions.

Puttable preferred shares represented 62 percent of all closed-end fund preferred share assets at year-end 2022.

What are mandatory redeemable preferred shares?

Mandatory redeemable preferred shares pay dividends that may be fixed or variable. The shares have a stated liquidation value that the fund sponsor is required to redeem for cash or other assets at the stated maturity date.

Floating mandatory redeemable preferred shares represented 17 percent and fixed mandatory redeemable preferred shares represented 3 percent of all closed-end fund preferred share assets at year-end 2022.

April 2023