Frequently Asked Questions About 401(k) Plans: The Basics

What is a 401(k) plan and how does it work?

Where does the 401(k) plan get its name from? How long have 401(k) plans existed?

Are 403(b) and 457 plans similar to 401(k) plans?

How have 401(k) plans grown since their introduction?

What are the benefits of investing in a 401(k) plan?

What is an employer match?

What is vesting?

Is there a limit to how much an employee and employer can contribute to a 401(k) plan?

What is a catch-up contribution and who is eligible?

What happens if an employee or employer contributes more than the 401(k) plan limit?

Can participants borrow from their 401(k) plan accounts?

What happens to an employee’s loan if an employee leaves a job or is fired?

What happens if an employee can’t repay a 401(k) loan?

What are the disadvantages to a 401(k) loan?

What are hardship withdrawals?

What are the disadvantages of a hardship withdrawal?

When can a participant begin drawing down a 401(k) plan?

What is a required minimum distribution?

Why do required minimum distributions exist?

What is a 401(k) plan and how does it work?

A 401(k) plan is an employer-sponsored retirement savings plan that allows an employee to contribute a portion of his or her paycheck into a tax-advantaged investment account. The employee (or plan participant) typically chooses from a range of investment options within the 401(k) plan. These options, which often include mutual funds, are chosen by the plan sponsor—usually the employer. Approximately half of all assets in 401(k) plans are invested in mutual funds, which in turn are invested in stocks, bonds, and short-term investments.

Generally, two types of contributions can be made to a 401(k) plan: pretax and Roth. Roth contributions have only been allowed starting in 2006, and the 401(k) plan sponsor decides whether to add the feature to the plan.

In a pretax (or traditional) 401(k) plan account, taxes are deferred on an employee’s contributions; that is, the contribution is taken out of an employee’s paycheck before taxes and is only taxed when it is withdrawn from the 401(k) plan account, usually during retirement. Because contributions are tax-deferred, they lower an employee’s taxable income in the year of the contribution. For example, if an employee contributes $3,000 to a 401(k) plan in any given year, the employee is taxed on his or her income for that year minus $3,000, because the employer took out the $3,000 before taxes. Investment returns in a traditional 401(k) plan account, such as dividends or interest, are not taxed as they are reinvested in the account. When the retirement investors take withdrawals from the account, the amounts withdrawn are included in taxable income. Early withdrawals—before age 59½—generally also are subject to a 10 percent tax penalty.

For a Roth 401(k) plan account, the tax treatment is different. The employee’s contribution to a Roth 401(k) plan account is counted as taxable income in the year the contribution is made. Contributions and investment returns are then withdrawn tax-free in retirement, as long as the participant is 59½ years old and has had the Roth 401(k) plan for at least five years. Withdrawals of investment returns not meeting these criteria are subject to income tax and possibly a 10 percent tax penalty.

Where does the 401(k) plan get its name from? How long have 401(k) plans existed?

The 401(k) plan gets its name from the section number and subsection in the Internal Revenue Code—Section 401, subsection (k)—that permit deferral of compensation at the employee’s election.

Established by the Revenue Act of 1978, legislators wrote Section 401(k) to address a narrow tax issue that pitted the Internal Revenue Service (IRS) against employers who wanted to offer “cash or deferred arrangements” in tax-favored profit-sharing plans. Section 401(k) permitted employees to put a portion of their compensation into the plan and pay taxes on it later, rather than taking all of their compensation immediately and paying taxes upon receipt.

Although Congress passed Section 401(k) in 1978, it was not until November 10, 1981, that the IRS formally described the rules for 401(k) plans. In the years immediately following the issuance of those rules, large employers typically offered 401(k) plans as supplements to their defined benefit (DB) retirement plans (commonly known as traditional pensions), with few employers offering them to employees as stand-alone retirement options. Now 401(k) plans are the most common and one of the most successful employer-sponsored retirement plans available to workers today.

Are 403(b) and 457 plans similar to 401(k) plans?

Yes and no. Both 403(b) and 457(b) plans are tax-deferred retirement plans that are similar to 401(k) plans, but 403(b) and 457(b) plans are only available to specific types of employers. 403(b) plans are only available to public schools, colleges and universities, nonprofit organizations that qualify as 501(c)(3)s, and churches. 457 plans are only available to state and local governments and certain nonprofit organizations. The rules vary for each type of plan, but the main objective behind each of them is to offer workers a convenient way to save paycheck-by-paycheck in a tax-deferred retirement plan at work.

How have 401(k) plans grown since their introduction?

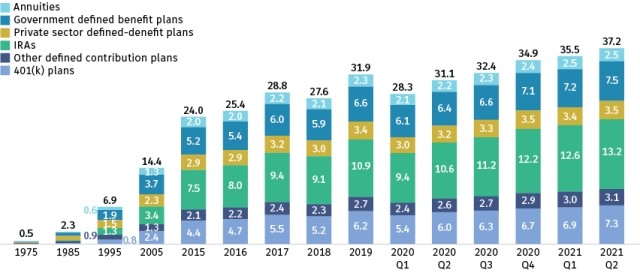

The 401(k) plan has grown to become the most widespread private-sector employer-sponsored retirement plan in the United States. 401(k) plans currently are the most popular type of defined contribution (DC) plan, representing the largest number of participants and assets in private-sector plans. They also have grown as a component of the entire US retirement market.

401(k) Plan Assets Have Grown in Importance

Trillions of dollars, end-of-period, selected dates

Note: For definitions of plan categories, see Table 1 in the most recent report of “The US Retirement Market” available here. Components may not add to the total because of rounding.

As of March 31, 2021, 401(k) plans held an estimated $6.9 trillion in assets and represented nearly one-fifth of the $35.4 trillion retirement market, which includes employer-sponsored retirement plans, individual retirement accounts (IRAs), and annuities.

What are the benefits of investing in a 401(k) plan?

401(k) plans are one of the most popular and successful retirement saving tools. They offer several benefits:

- Tax planning. A traditional 401(k) plan reduces an employee’s immediate taxable income because contributions are tax-deferred. Many participants anticipate being in a lower tax bracket in retirement compared to their peak earning years, which may result in lower tax rates on 401(k) plan withdrawals in retirement. However, some participants, such as young employees with many working years ahead of them, may anticipate being in a higher tax bracket at retirement. If the 401(k) plan offers Roth 401(k) plan accounts, these participants can choose to pay tax on their contributions up front and pay no tax upon withdrawal. The ability to set aside some of their income on a tax-deferred basis, and in some cases to determine how their own contributions are allocated between a traditional and Roth 401(k), is just one way that 401(k) plans allow plan participants flexibility in tax planning for retirement.

- Tax-deferred growth. The money saved in a 401(k) plan grows and compounds more quickly because the total balance in the account isn’t taxed on a yearly basis.

- Employer match. Many 401(k) plan participants can increase their savings by taking advantage of an employer match—an additional contribution made by the employer that depends on how much the employee contributes.

In addition to those benefits, 401(k) plans are especially well suited for today’s economy because they are portable, employees have full ownership of their vested contributions and investment returns, and the 401(k) industry is constantly innovating to ensure that it keeps up with an evolving job market and workforce.

What is an employer match?

As part of an employee benefit package, and to encourage employees’ retirement saving, an employer may offer to match a certain amount of an employee’s 401(k) plan contribution. For example, an employer might match 50 cents on a dollar of a worker’s contribution up to 6 percent of pay. In this case, if an employee earns $50,000 and contributes 6 percent of pay to a 401(k) plan ($3,000), the employer would contribute 3 percent ($1,500) to the account, for a total contribution of 9 percent ($4,500). Alternatively, an employer might decide, for example, to match dollar for dollar up to 3 percent of pay, in which case, an employee earning $50,000 would get $1,500 in employer match for $1,500 of their own contributions.

Employers can make matching contributions on an employee’s Roth 401(k) plan contributions; however, the employer must allocate any matching contributions into a traditional pretax 401(k) plan account.

What is vesting?

Vesting refers to the rights of ownership of a 401(k) plan account balance. Any funds contributed by the employee are, under the Employee Retirement Income Security Act of 1974 (ERISA), fully vested—or owned outright by the employee with no risk of forfeiture. However, contributions made by the employer on a worker’s behalf may be subject to a vesting period, which is the amount of time an employee has to work for an employer before earning the rights to the company’s contributions to his or her account. Vesting schedules vary from company to company, and often phase an employee in to full ownership rights over several years. When an employee is fully vested, it means he or she has earned the rights to all of the money an employer has contributed on his or her behalf to the 401(k) plan account.

For example, a company might start contributing to an employee’s 401(k) plan account right after he or she starts participating in the plan. However, if the plan has a one-year vesting requirement, the employee will only have full ownership rights in that money after being employed there for a year. Once the employee works a year, he or she is fully vested in the employer’s contributions already made and going forward.

Is there a limit to how much an employee and employer can contribute to a 401(k) plan?

Yes. As of 2021, an employee can defer up to $19,500 total to a 401(k) plan per year as pretax or Roth contributions. If an employee is 50 years or older, the employee can defer up to $26,000 as pretax or Roth contributions by taking advantage of a $6,500 catch-up contribution.

What is a catch-up contribution and who is eligible?

A catch-up contribution is an additional contribution to a 401(k) plan that can only be made by an employee who is at least 50 years old. Once an employee has hit the plan’s contribution limit or the annual deferral limit of $19,500 (in 2020), he or she may contribute up to $6,500 as a catch-up contribution. Most employers offer this option, and some companies also match a percentage of the catch-up contribution.

What happens if an employee or employer contributes more than the 401(k) plan limit?

The possibility of contributing too much is not usually an issue because most employers automatically stop contributions once an employee hits the annual limit. It can become an issue if an employee changes jobs, however, because when an employee begins working for a different company, the new employer may not know how much the employee contributed at his or her old company. The employee may not know or may not tell the new company, causing the new company or employee to inadvertently contribute too much to the employee’s 401(k). In this case, the employee should alert their employer and any excess should be removed from the plan.

Can participants borrow from their 401(k) plan accounts?

Yes, if the plan allows loans. The maximum amount an employee can borrow from a 401(k) plan generally is the lesser of 50 percent of the vested account balance or $50,000.

Every plan is different, but some companies only allow employees to take out loans for specific reasons. Some companies also might have specific conditions under which they will allow the loan. For example, an employer may have a minimum loan amount or a company might limit the total number of loans that can be outstanding at one time. If an employee is married, the employer may require the spouse’s consent to the loan.

An employee must pay back a loan in five years, unless he or she uses the loan to buy a home (a principal residence). In that case, the company may extend the loan based on its own discretion. 401(k) loans are not subject to taxes or penalties (unless the employee defaults or the loan otherwise violates the loan rules), but an employee does have to pay interest on the loan. The plan administrator decides what the interest will be, which is usually based on the current prime rate of interest. Unlike many other types of loans, the employee pays the interest to his or her plan account—not to a bank or other lender.

What happens to an employee’s loan if an employee leaves a job or is fired?

Depending on the plan’s policy, the employee may be required to pay back the loan right away or pay the remaining amount to an IRA or another plan as a rollover within 60 days.

What happens if an employee can’t repay a 401(k) loan?

If an employee can’t repay a loan, the money will be treated as distributed, or withdrawn. The individual will be taxed on the outstanding balance and—unless the employee is at least 59½ years old—may face an early withdrawal penalty.

What are the disadvantages to a 401(k) loan?

The main disadvantage of taking a loan is the possibility that the participant will be unable to pay it back. Another is that borrowing from a 401(k) may slow the growth of the account, because the money borrowed is not earning investment returns as it would in the plan.

What are hardship withdrawals?

A hardship withdrawal is another way an employee can access money from a 401(k) plan. Plan policies vary, but usually employees cannot withdraw more than they have contributed. A worker must meet certain requirements to qualify for a hardship withdrawal:

The hardship must be due to an immediate and heavy financial need. Under IRS rules, a need that falls under one of the categories below is deemed to be immediate and heavy:

- Buying a home or paying for certain home repairs

- Paying for education expenses such as tuition and related fees, or for those of a spouse, child, or primary beneficiary

- Preventing eviction from a primary residence

- Paying tax-deductible medical expenses that are not reimbursed to an employee, spouse, child, or primary beneficiary

- Paying for funeral expenses of a parent, spouse, child, or primary beneficiary

The amount must be necessary to satisfy the need (including that the employee can’t get the money from other sources).

Some plans require the employee to have exhausted all nonhardship distributions and other loans available from plans maintained by that employer.

What are the disadvantages of a hardship withdrawal?

There are a several disadvantages to taking a hardship withdrawal. One of the disadvantages is that a hardship withdrawal slows a 401(k)’s growth. The money withdrawn does not earn investment returns as it would in a 401(k) plan, and in some cases, an employee can’t contribute to his or her 401(k) plan until six months after the withdrawal. Another disadvantage is that hardship withdrawals are taxable and may be subject to a 10 percent penalty if the employee is not at least 59½ years old.

When can a participant begin drawing down a 401(k) plan?

A participant can start drawing down a 401(k) plan, penalty free, once he or she is 59½ years old. A participant generally must start withdrawing the required minimum distribution (RMD) from a 401(k) plan by April 1 of the first year after the later of the calendar year in which the participant retires or reaches age 702. For example, if a participant reaches 72 years of age in February 2021, he or she doesn’t have to withdraw the initial RMD until April 1, 2022. If that same participant retires in May 2021, the plan may allow him or her to postpone the RMD until April 1, 2022. These rules and requirements apply to a Roth 401(k) as well.

What is a required minimum distribution?

A required minimum distribution (RMD) is the minimum amount a person must withdraw from a 401(k) plan once that person is retired and 72 years old. If an employee is still working at age 72, they may be permitted to delay withdrawing the RMD from the 401(k) until retirement (unless they are a five percent owner of the company sponsoring the plan). If a person does not withdraw the RMD, they will be fined 50 percent of the required amount not withdrawn and will still have to pay taxes on the taxable portion of the full RMD. The amount of each person’s annual RMD is based on the value of the 401(k) plan account at the prior year-end and a distribution period corresponding to the individual’s age (available through the IRS’s life expectancy tables). If a person has more than one 401(k) plan account, he or she must calculate and withdraw the RMD for each account separately.

Why do required minimum distributions exist?

The government requires 401(k) plan participants to withdraw a minimum amount from their 401(k) plan accounts on an annual basis to ensure that participants or their beneficiaries don’t avoid taxation altogether.

Additional Resources

October 2021