Working for America’s Middle Class

The US retirement system is the envy of the world, thanks largely to the success of defined contribution plans—such as 401(k)s—and individual retirement accounts (IRAs). Together with Social Security, employer plans and IRAs have helped build the middle class, giving millions of everyday Americans a financially secure retirement.

Retirement plans generate wealth and income for retirees.

- Voluntary retirement plans have progressed significantly over time. Adjusted for inflation, retirement assets per household are more than seven times what they were in 1975.

- The typical 72-year-old replaces more than 90 percent of the inflation-adjusted spendable income they had in their late 50s, thanks to both Social Security benefits and retirement plan income.[1]

- 90 percent of 401(k) participants receive contributions from their employers.[2]

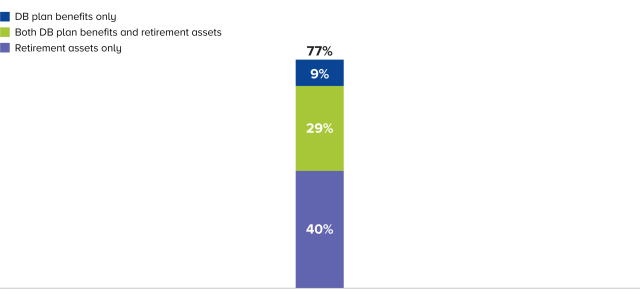

- More than three-quarters of near-retirement households had DB benefits, DC or IRA assets, or both in 2022, with seven in 10 near-retirement households having retirement savings.

Near-Retiree Households Have Retirement Assets, DB Plan Benefits, or Both[3]

Percentage of near-retiree households, 2022

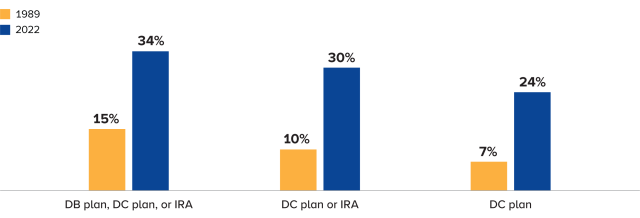

Financial education and improvements in the design of workplace retirement plans, such as automatic enrollment provisions, have led more young households to save for retirement.

- Young households are more engaged in retirement saving than prior generations.

Percentage of Households Aged 18 to 25 With a Retirement Account[4]

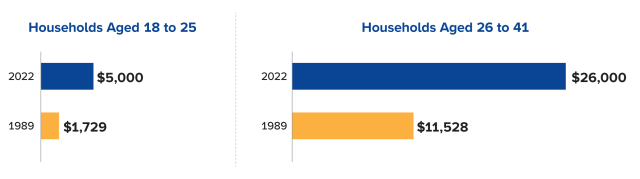

- Young households have more saved in DC plans than their same-age counterparts had decades ago.

Median DC Plan Assets, in 2022 US dollars, for Households with DC Plans[5]

Vibrant competition in the fund industry benefits middle-class Americans.

- Fees on mutual funds in 401(k) plans have fallen dramatically over time, letting retirement savers keep a greater share of their investment gains. Since 2000, equity mutual fund expense ratios in 401(k)s are down 57% and bond mutual fund expense ratios are down 63%.[6]

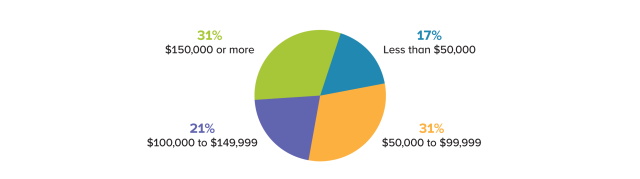

Registered investment funds are owned by a diverse range of Americans, reflecting the prevalence of DC retirement plans in the workforce and the rise of investing culture in the US.

- Today, about 116 million Americans, or 52% of US households, own mutual funds.[7]

- Nearly half of mutual fund–owning households earn less than $100,000 per year.

Mutual Fund–Owning Households by Household Income[8]

Percentage of US households owning mutual funds, 2023

Supporting Policies that Work

Americans overwhelmingly support the core features of their retirement accounts and reject policy proposals that would take them away.[9]

- About nine in 10 Americans disagree with proposals to remove or reduce tax incentives for retirement savings.

- Nearly nine in 10 Americans disagree with the idea of not allowing individuals to make investment decisions in their DC accounts.

- Roughly nine in 10 Americans agreed that retirees should be able to make their own decisions about how to manage their own retirement assets.

The Bottom Line

Retirement plans are thriving, putting more Americans on the road to retirement and a secure financial future.

By preserving the features of voluntary retirement plans that Americans love and building on their successes, policymakers can add strength to the middle class today and for generations to come.

Notes

[1] Source: Peter Brady and Steven Bass of ICI. When I’m 64 (or Thereabouts): Changes in Income from Middle Age to Old Age. May 2023.

[2] Based on ICI tabulations of US Department of Labor Form 5500 Research File.

[3] Near-retiree households are those with a head of household aged 55 to 64, and a working head of household or working spouse. Households with DB plan benefits include households currently receiving DB plan benefits and households with the promise of future DB plan benefits, whether from private-sector or government employers. Retirement assets include DC plan assets (401(k), 403(b), 457, thrift, and other DC plans), whether from private-sector or government employers, and IRAs (traditional, Roth, SEP, SAR-SEP, and SIMPLE). Source: ICI tabulations of Federal Reserve Board Survey of Consumer Finances

[4] Note: Age is based on the age of the reference person. Households currently receiving DB plan benefits and households with the promise of future DB plan benefits, whether from private-sector or government employers, are counted in the DB plan category. DC plan assets (401(k), 403(b), 457, thrift, and other DC plans) and assets held in SEP, SAR-SEP, or SIMPLE plans, whether from private-sector or government employers, are counted in the DC plan category. Traditional and Roth individual retirement account assets are counted in the IRA category.

Source: ICI tabulations of Federal Reserve Board Survey of Consumer Finances.

[5] Based on ICI tabulations of Federal Reserve Board Survey of Consumer Finances.

[6] See ICI Research Perspective, "The Economics of Providing 401(k) Plans: Services, Fees, and Expenses, 2022."

[7] See ICI, Profile of Mutual Fund Shareholders, 2023.

[8] Note: Total reported is household income before taxes in 2022.

Source: ICI, Profile of Mutual Fund Shareholders, 2023.

[9] See ICI, American Views on Defined Contribution Plan Saving, 2023.